Smart-HR / Our Solutions

Payroll & Tax

Simplicity defines our Payroll Module. Transmit time and attendance, perform calculations as you go and receive a set of customizable reports to monitor payroll in real time. When accuracy is critical, our robust tax engine handles time-consuming tasks, offers automated multi-state and reciprocity calculations and our local tax jurisdiction locator suggests applicable taxes. Simplify even more by empowering employees to access their payroll information 24/7 and update their direct deposit and tax information via a secure portal.

Module Highlights

Dedicated Partner Support Person

Dedicated Partner Support Person

Access a direct payroll professional for all of your payroll questions.

Access a direct payroll professional for all of your payroll questions.

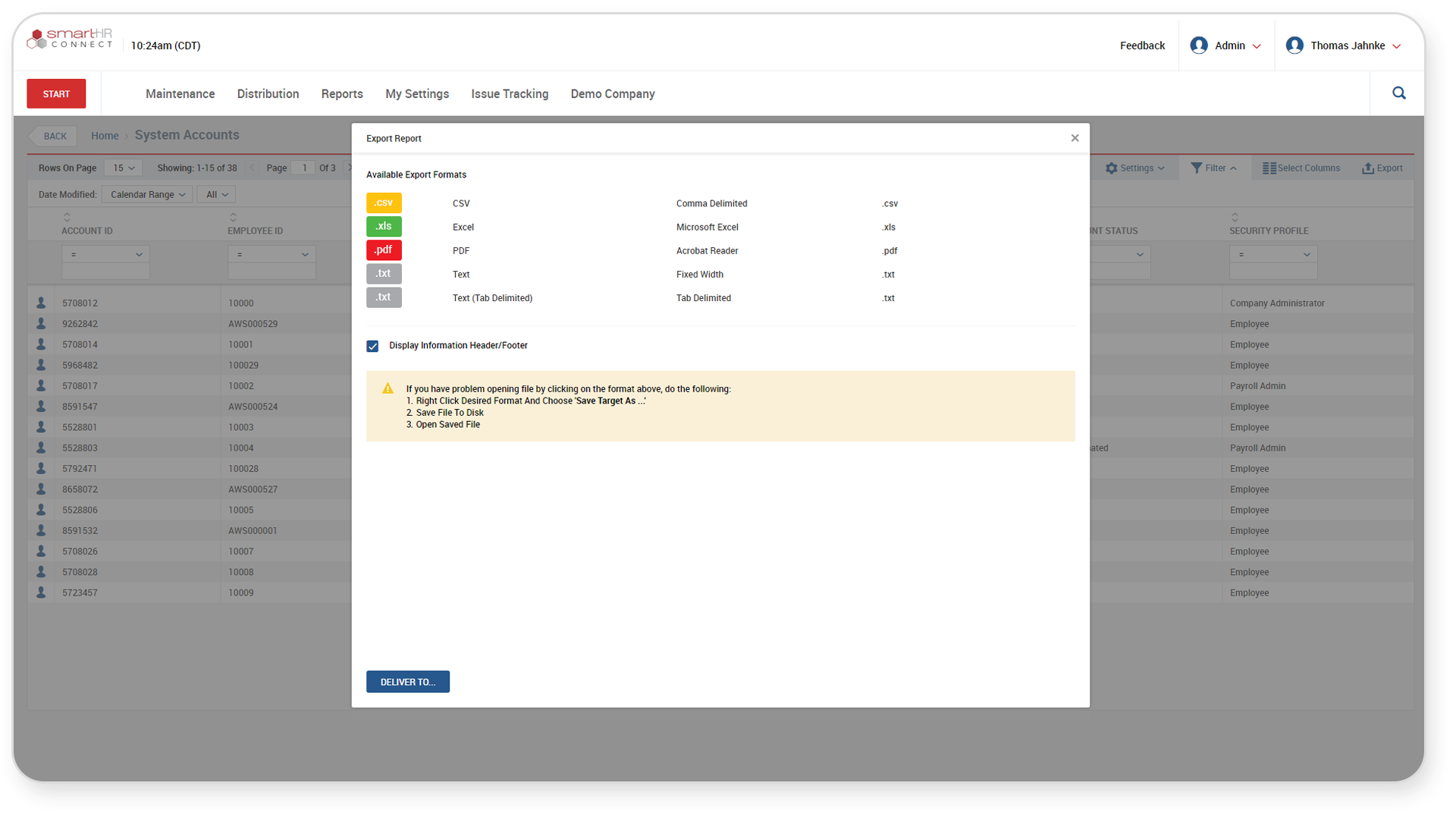

Robust, exportable reporting

Robust, exportable reporting

Choose from a wide range of export options, including CSV, Excel, PDF and XML.

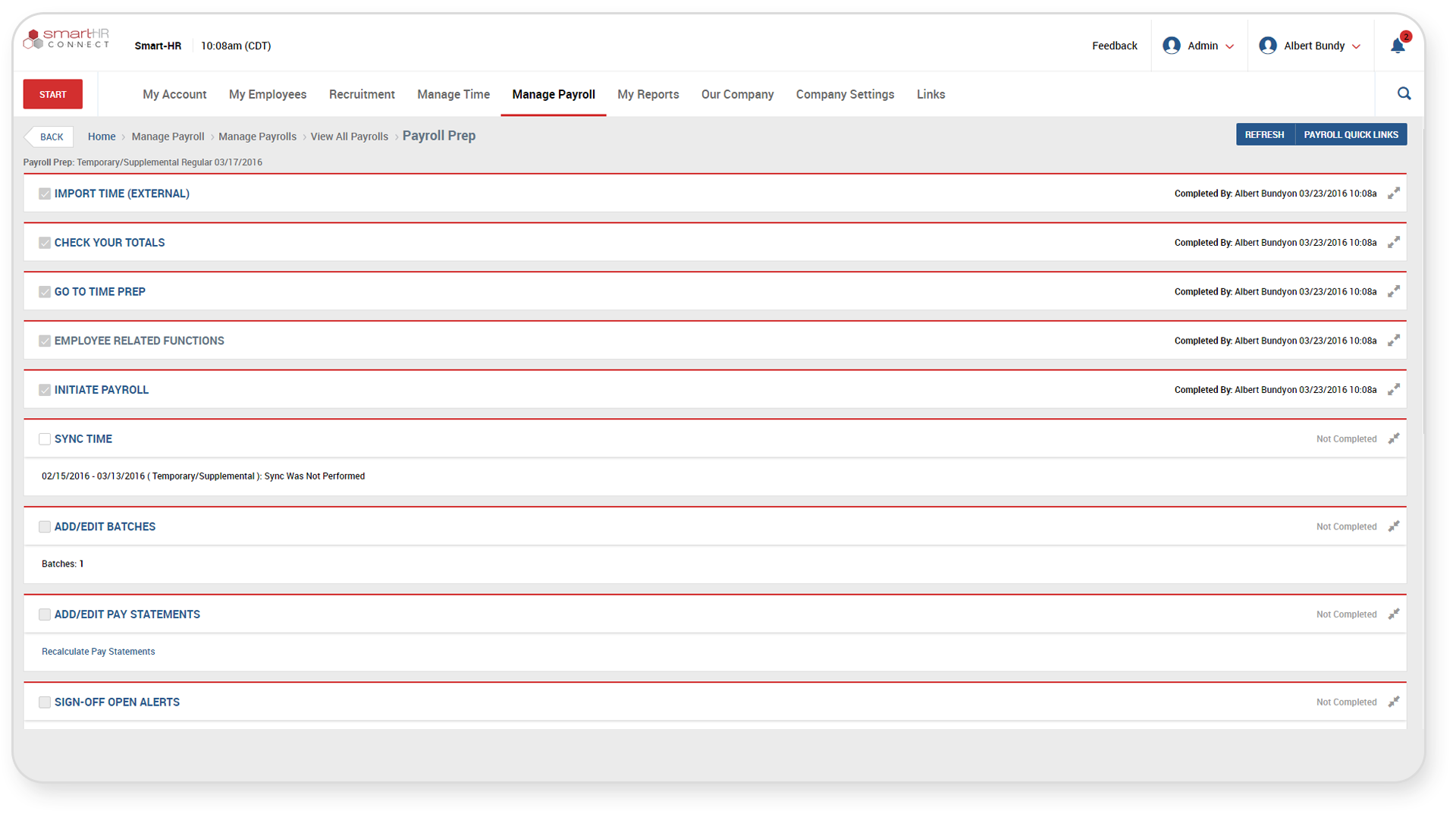

Online Payroll Processing

Online Payroll Processing

No preprocessing steps are needed in order to preview pay statements for employees prior to finalization.

Employee Self Service

Employee Self Service

Receive your pay statement notification for a quick and easy export from your secure portal.

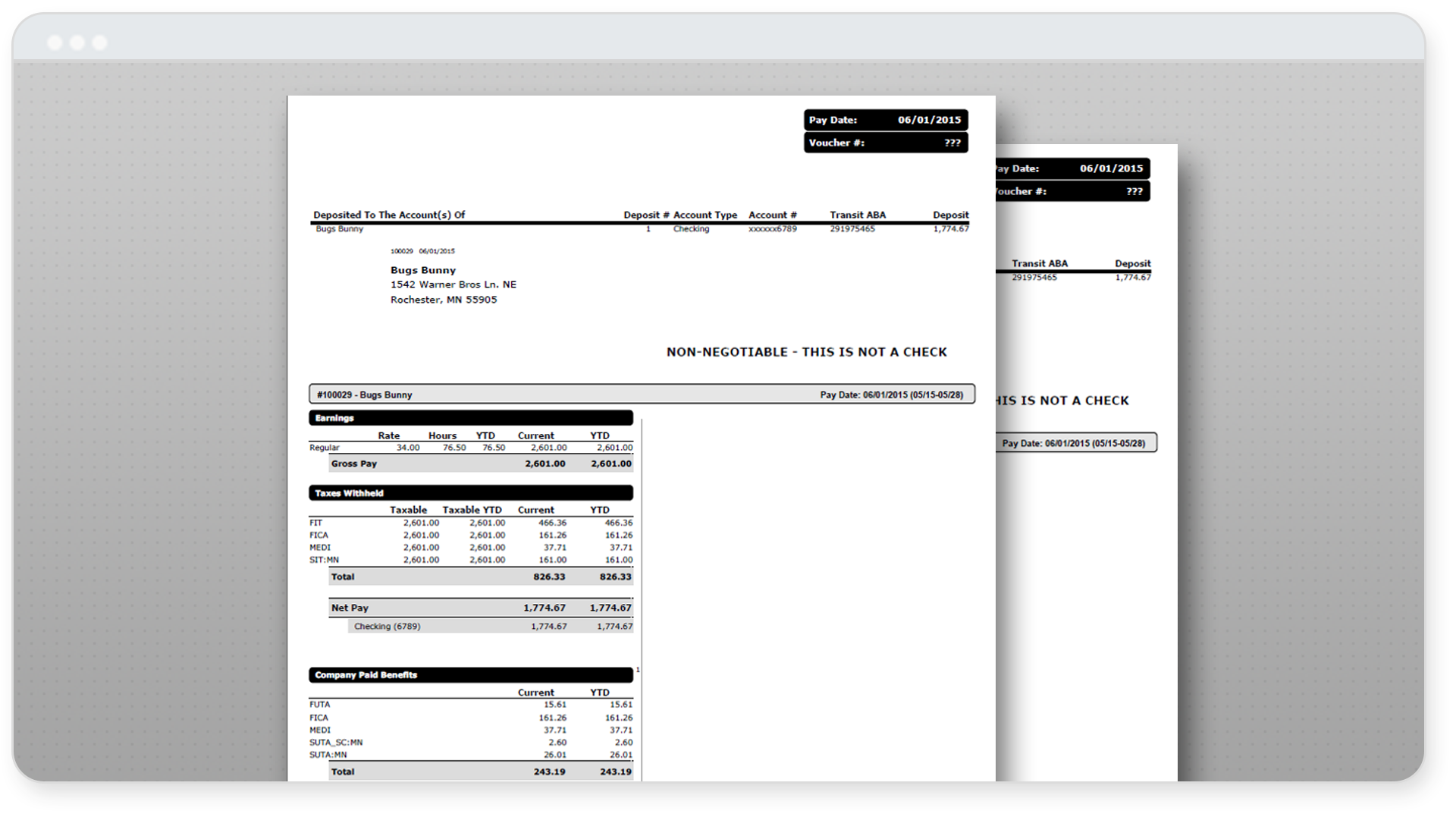

Direct Deposit & Paystub Printing

Direct Deposit & Paystub Printing

Employees can change their direct deposits and print any pay stub produced.

New Hire Reporting

New Hire Reporting

Let us handle the administration of new hire reporting requirements for Personal Responsibility Work Opportunity Reconciliation Act (PRWORA) compliance.

Reduce employment liability and save administration time!

Tax Management

Tax Management

Built in geospatial tax identification provides accurate coordinates of a work address for effective tax preparation.

Garnishment Processing

Garnishment Processing

Let us take care of any employee tax liens and send them directly to the appropriate taxing authority.